north carolina estate tax return

North Carolina Estate Tax Exemption. Your North Carolina State Individual Tax Return for Tax Year 2021 January 1 - Dec.

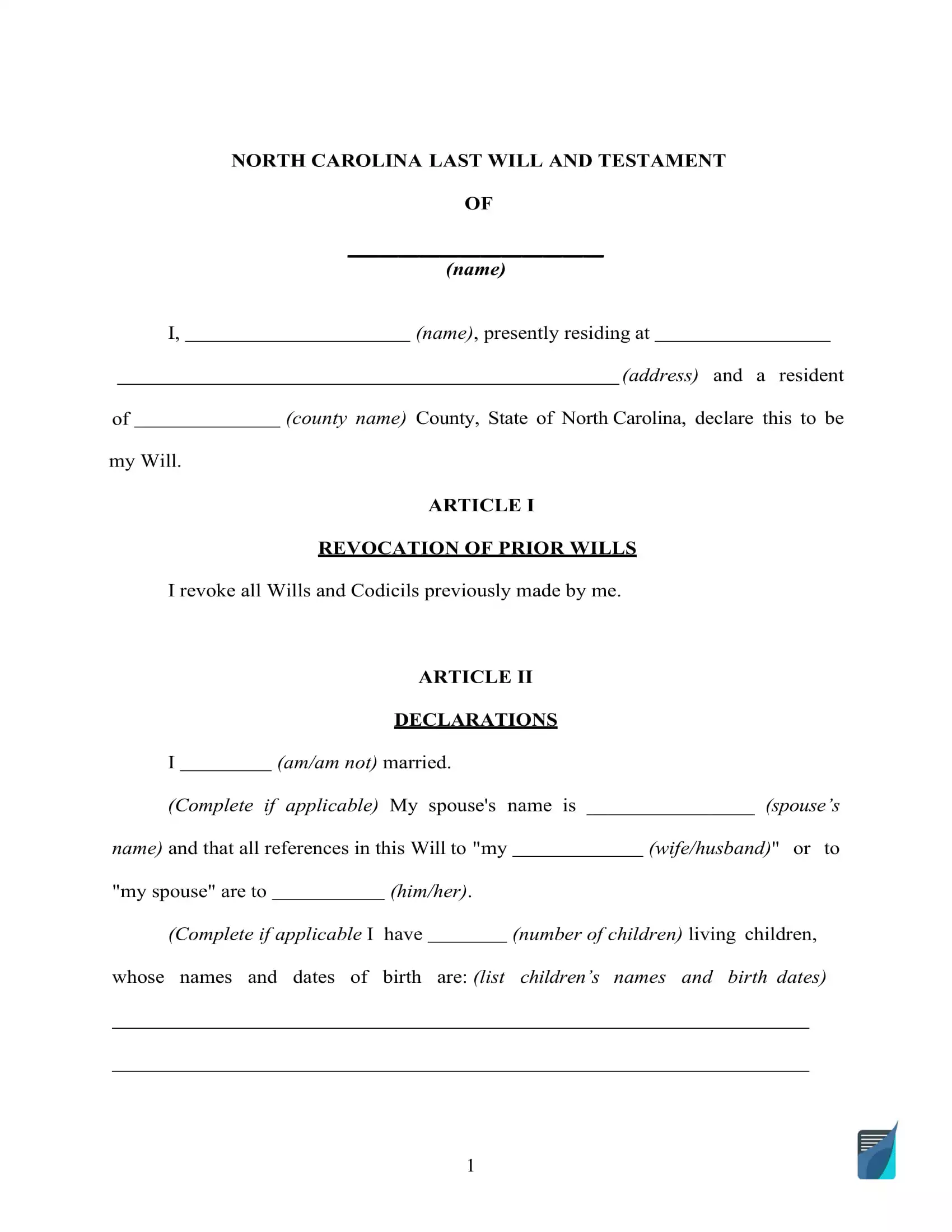

North Carolina Last Will And Testament Form Nc Will Template

North Carolina currently does not enforce an estate tax often referred to as the death tax But the federal government levies the estate.

. Estate Taxes for Married Couples Portability. North Carolina chooses a joint system which adds the incomes of both spouses in a married couple together and taxes it as a single amount. Federal Estate Tax.

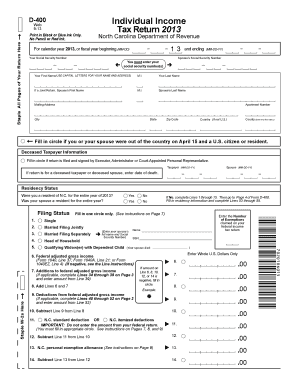

For a decedent who died on or after 111999 but prior to 112013 use AOC-E-212. 105-1535a2 allows a taxpayer in calculating North Carolina taxable income to deduct from adjusted gross income either the North Carolina standard deduction amount or the North Carolina itemized deduction amount. Even though North Carolina has neither an estate tax or nor an inheritance tax the federal estate tax still applies to North Carolinians depending on the value of their estate.

North Carolina property tax rates range from a low of 042 percent in Watauga County to a high of 122 percent in Durham County. Like the Federal Form 1040 states each provide a core tax return form on which most high-level income and tax calculations are performed. If you are inheriting from someone in another state your inheritance may also be subject to a state death tax from the originating state.

An estates tax ID number is called an employer identification. Form D-407 Income Tax for Estates and Trusts must be filed for an estate for the period from the date of death to the end of the taxable year if the estate had taxable income from North Carolina sources or income which was for the benefit of a North Carolina resident and the estate is required to file a federal tax return for. Previous to 2013 if a North Carolina resident died with a large estate it might have owed both federal estate tax and a separate North Carolina estate tax.

In this article we break down North Carolinas inheritance laws including what happens if you die without a valid will and what happens to your property. 6 Things Every Homeowner Should Know About Property Taxes. Link is external 2021.

An estate tax certification under GS. While there isnt an estate tax in North Carolina the federal estate tax may still apply. The federal estate tax exemption was 1170 million for deaths in 2021 and goes up to 1206 million for deaths in 2022.

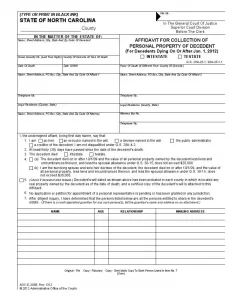

28A-21-2a1 is not required for a decedent who died on or after 112013. Application for Extension D-410P for Filing Partnership Estate or Trust Tax Return Web 8-19 Instructions Purpose - Use Form D-410P to ask for 6 more months to file the North Carolina Partnership Income Tax Return Form D-403 or the North Carolina Estates and Trusts Income Tax Return Form D-407. North Carolina is currently delayed in issuing guidance for.

North Carolina Estate and Inheritance Taxes. PDF 33315 KB - December 30 2019. The North Carolina General Assembly approved eliminating the states tax on military pension income in the fiscal budget that was.

North Carolina repealed the state-level estate tax in July 2013 effective retroactively for deaths occuring on January 1 2013 or later. While some taxpayers with simple returns can complete their entire tax return on this single form in most cases various other additional schedules. Form D-407 is a North Carolina Corporate Income Tax form.

Taxes in North Carolina. Download or print the 2021 North Carolina Application for Extension for Filing Partnership Estate or Trust Tax Return 2021 and other income tax forms from the North Carolina Department of Revenue. Ad Edit Sign or Email IRS 706 More Fillable Forms Register and Subscribe Now.

31 2021 can be prepared online via eFile along with a Federal or IRS Individual Tax Return or you can learn how to complete and file only a NC state returnThe latest deadline for e-filing NC State Tax Returns is April 18 2022. Thus for deaths occurring on January 1 2013 or later only the Federal estate tax rules apply for North Carolina decedents. Complete this version using your computer to enter the required information.

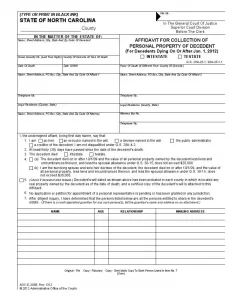

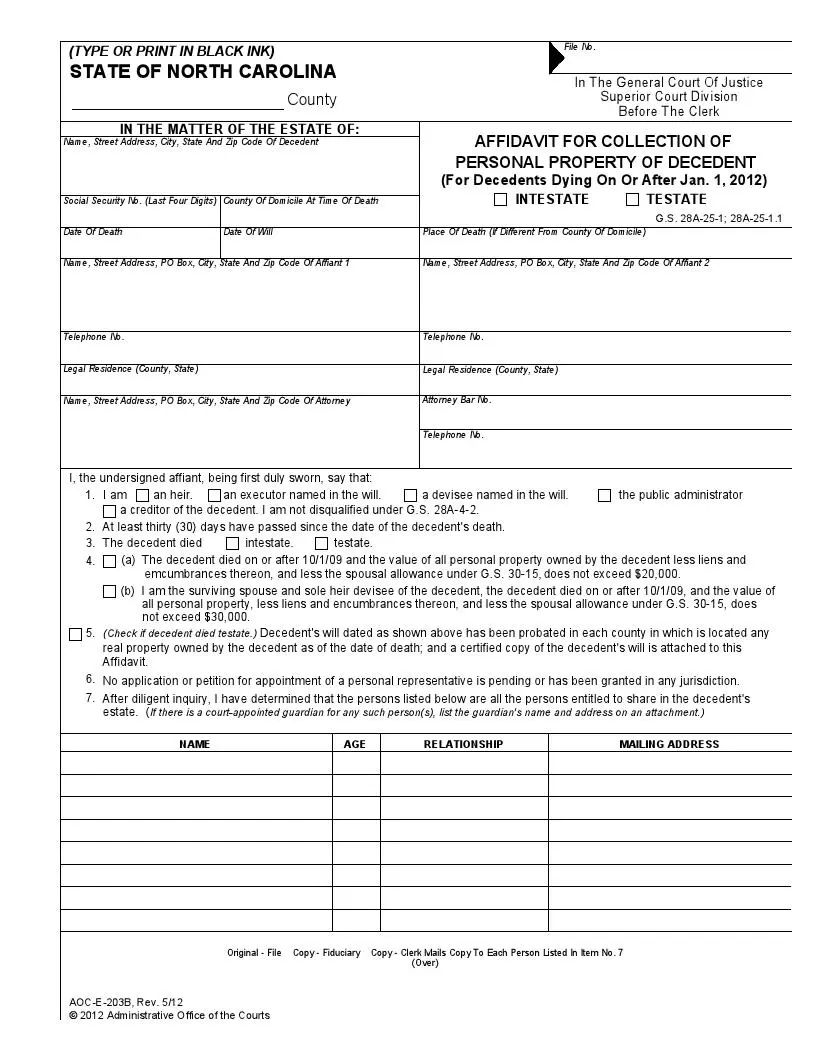

Filing Requirement-- A North Carolina Estate Tax Return Form A-101 is required to be filed by the personal representative if a federal estate tax return Form 706 is required to be filed with the Internal Revenue Service and the decedent was domiciled in North Carolina at death or the decedent owned real property or tangible personal property located. Last week the North Carolina House Finance Committee approved repeal of the states death tax. IN THE MATTER OF THE ESTATE OF STATE OF NORTH CAROLINA County NOTE.

Effective January 1 2013 the North Carolina legislature repealed the states estate tax. North Carolina doesnt charge an estate tax or an inheritance tax at the state level. Recently we wrote about North Carolina potentially joining several other states that are repealing state estate tax or death tax.

Use this form for a decedent who died before 111999. NC K-1 Supplemental Schedule. Income Tax Return for Estates and Trusts is required if the estate generates more than 600 in annual gross income.

North Carolina Individual Income Tax Provisions Once a state decides to individually tax residents on their income they must determine which filing system to use. Then print and file the form. IRS Form 1041 US.

Some states still charge an Estate Tax Death Tax. Form A-101 Web North Carolina Estate Tax Return For deaths occuring on or after January 1 2005 Form A-101 Web North Carolina Estate Tax Return For deaths occuring on or after January 1 2002 and before January 1 2005 Form A-101 Webfill North Carolina Estate Tax Return For deaths occuring on or after January 1 2002 and before January 1 2005 Form. The decedent and their estate are separate taxable entities.

Beneficiarys Share of North Carolina Income Adjustments and Credits. Application for Extension for Filing Estate or Trust Tax Return. Before filing Form 1041 you will need to obtain a tax ID number for the estate.

The state exemption amount was tied to the federal one which means that for deaths in 2012 estates with a total. Owner or Beneficiarys Share of NC. Can a taxpayer deduct more than 10000 of real estate tax on a North Carolina return.

If you live or work in NC when you die your estate may be subject to these taxes. Estates and Trusts Fiduciary. More on Money.

/ScreenShot2020-02-03at1.41.37PM-322605a2b23a49598d9cdf9faee0a97a.png)

Form 706 United States Estate And Generation Skipping Transfer Tax Return Definition

North Carolina Estate Tax Everything You Need To Know Smartasset

Inheritance And Estate Settlement When Will I Get My Inheritance The American College Of Trust And Estate Counsel

State Employees Credit Union Tax Refund Information

North Carolina Low Income Tax Clinic Charlotte Center For Legal Advocacy

Free North Carolina Small Estate Affidavit Form Pdf Formspal

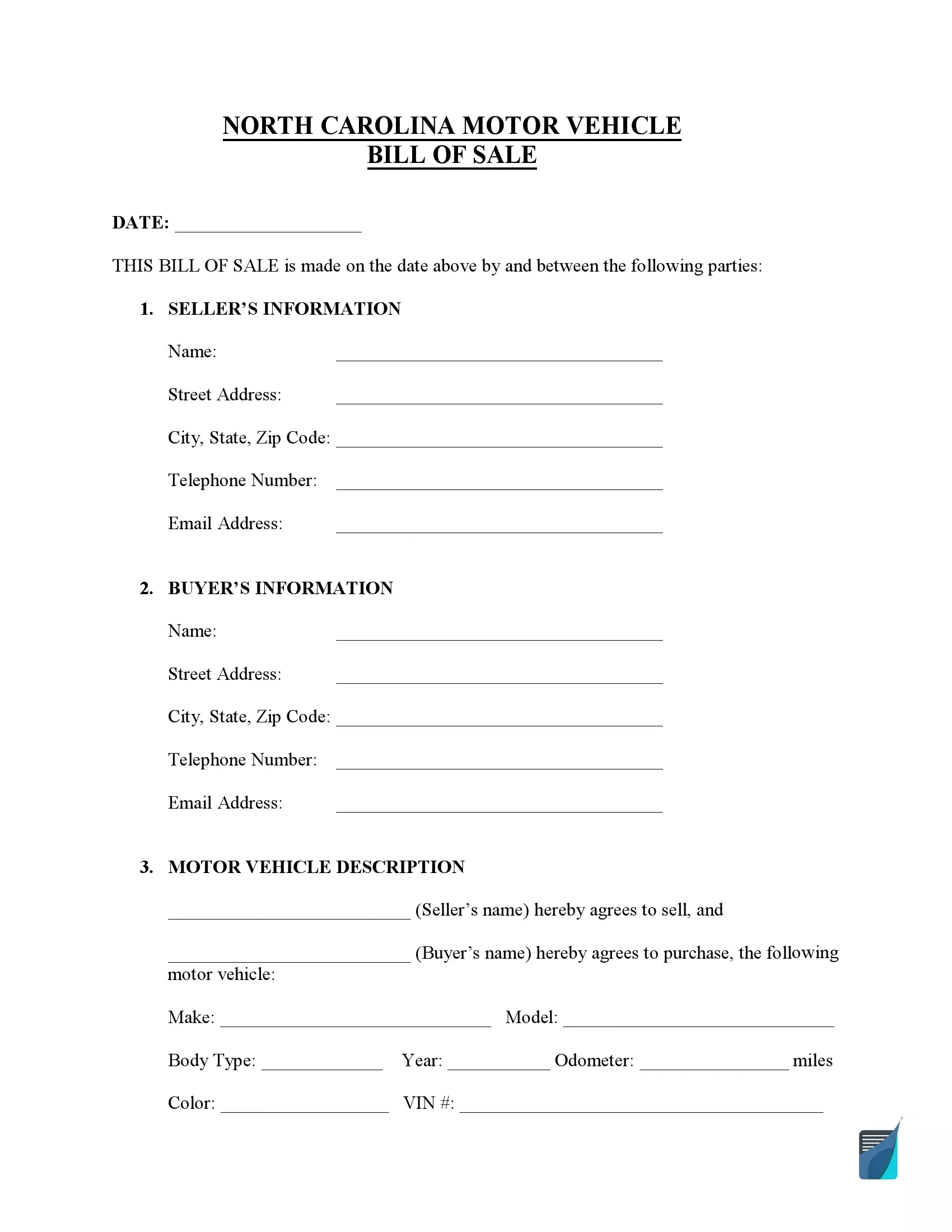

Free North Carolina Bill Of Sale Forms Formspal

North Carolina Income 2021 2022 Nc Forms Refund Status

3 11 106 Estate And Gift Tax Returns Internal Revenue Service

How Do State Estate And Inheritance Taxes Work Tax Policy Center

Stronger Estate Tax Would Hit More Inheritances Under Democrats Plan

Nc Tax Forms Pdf Fill Online Printable Fillable Blank Pdffiller

North Carolina Estate Tax Everything You Need To Know Smartasset

North Carolina Gift Tax All You Need To Know Smartasset

Free North Carolina Small Estate Affidavit Form Pdf Formspal

North Carolina Estate Tax Everything You Need To Know Smartasset